free crypto tax calculator australia

Since then its developers have been creating native apps for mobile devices and other upgrades. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

5 Best Crypto Tax Software Accounting Calculators 2022

As part of that commitment we are proud to offer all Australian crypto investors an easy solution to filing their taxes.

. Call 07 3088 9146. Download your tax documents. Canada was the first supported country followed by the US a few months later.

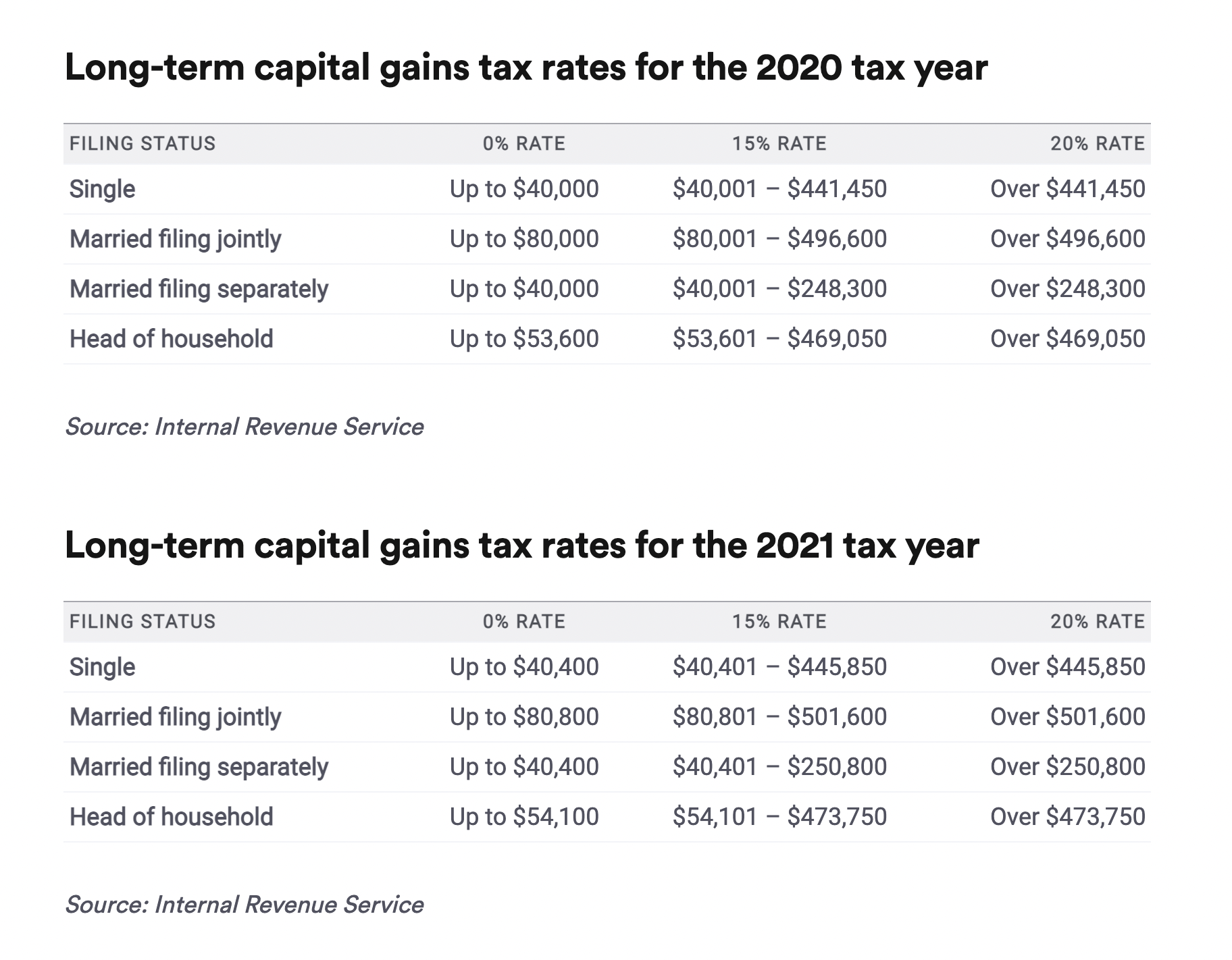

Online Crypto Tax Calculator with support for over 400 integrations. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly.

Australian citizens have to report their capital gains from cryptocurrencies. Whether you are filing yourself using a tax software like TurboTax or working with an accountant. Capital gains tax report.

Fullstack Provides The Best Crypto Tax Calculator in Australia With Over 20 Years of Experience. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Enter the price for which you purchased your crypto and the price at which you sold your crypto.

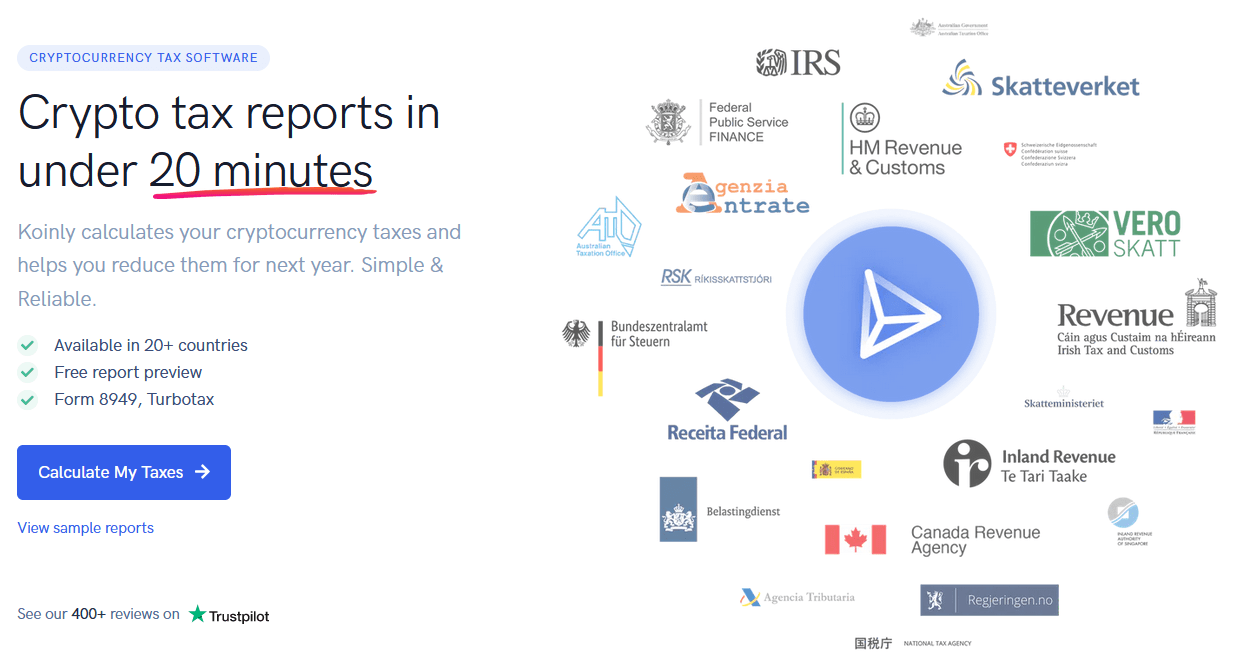

If you are filing in the US Koinly can generate filled-in IRS tax forms. If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional trader. ATO Tax Reports in Under 10 mins.

CoinTrackinginfo - the most popular crypto tax calculator. 49 for all financial years. After entering the 3 transactions into Koinly manually this is the output.

File your crypto taxes in Australia Learn how to calculate and file your taxes if you live in Australia. Koinly can generate the right crypto tax reports for you. To use this crypto tax calculator input your taxable income for 2022 before considering any crypto gains and your 2022 tax filing status.

Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. As Tim Brunette co-founder of Crypto Tax Calculator an Australian startup that has leapt up in the crypto-adjacent space recently told DMARGE crypto is gaining greater cultural purchase. It allows you to keep track of all your transactions for free and generate as many reports as you need with our yearly licenses.

We have long been committed to offering the most compliant and easy to use crypto platform in the world. To calculate the crypto taxes for Jed we are going to use Koinly which is a free online crypto tax calculator. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

Form 8949 Schedule D. Crypto Tax Calculator Estimate Your Australian Tax - Fullstack. As per the team around the feature the plan is to.

Sign up for free. Were excited to expand our free-to-use crypto tax reporting service to Australia. ZenLedger is much more than just a free crypto tax calculator.

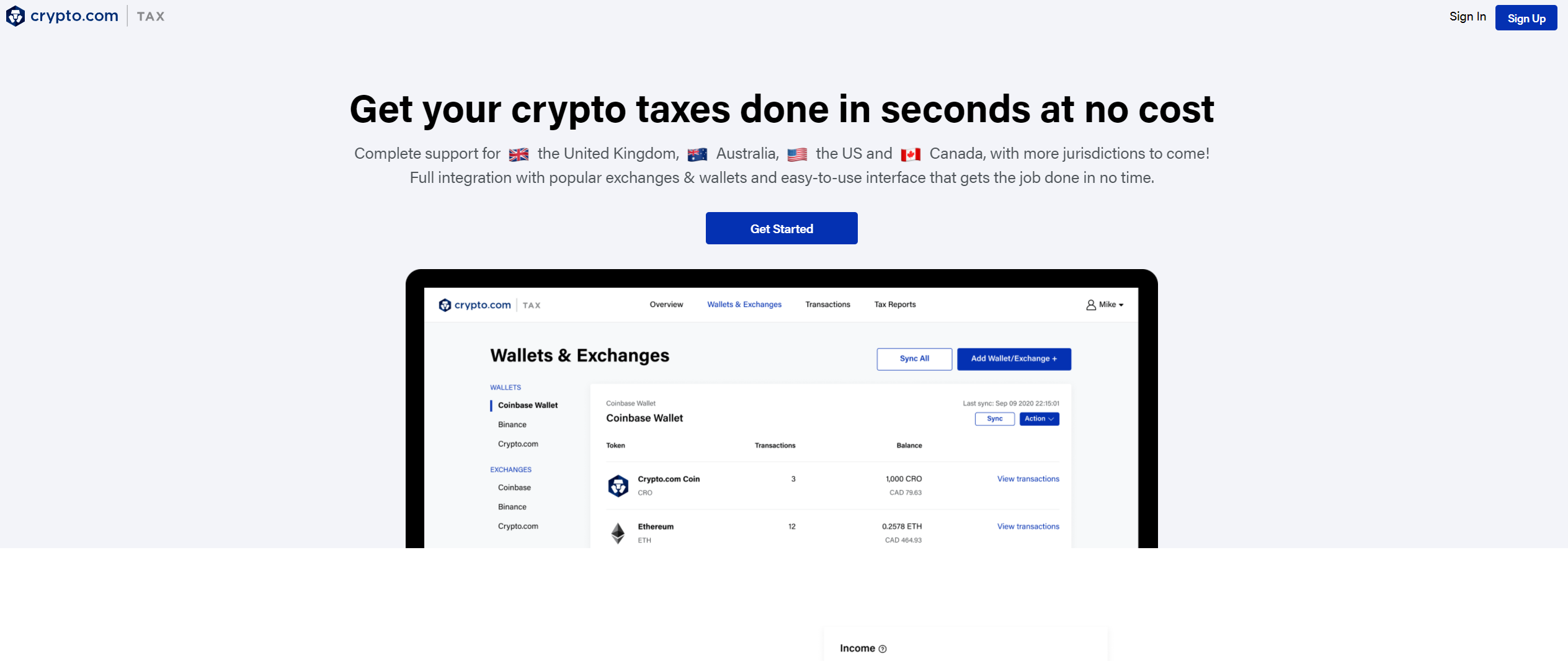

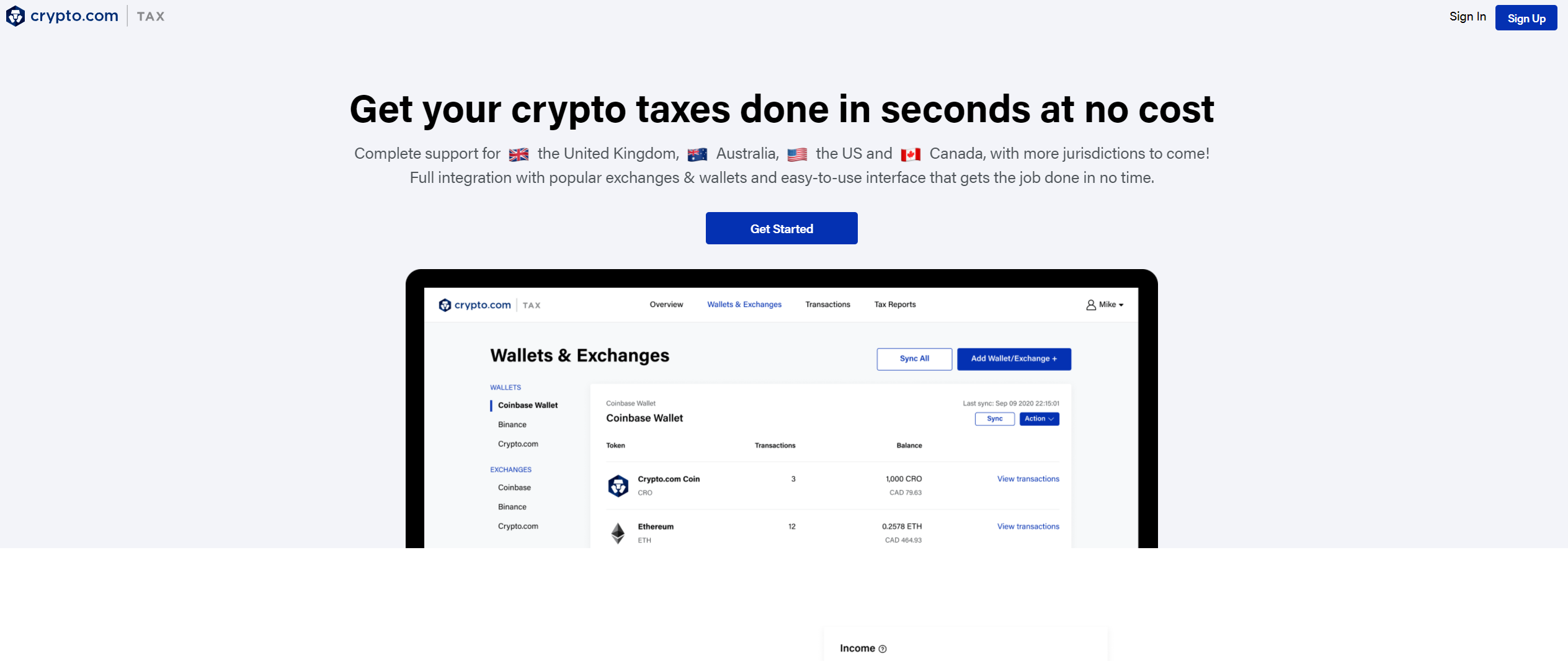

Straightforward UI which you get your crypto taxes done in seconds at no cost. Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes. More markets will be added soon said Kris Marszalek Co.

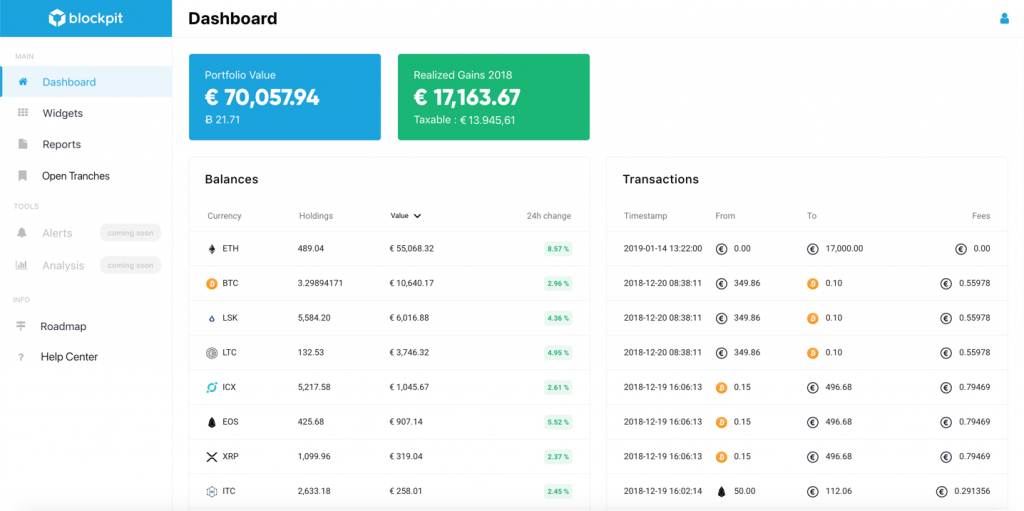

It provides the most accounting transparency of any cryptocurrency tax calculator. Calculate and report your crypto tax for free now. By just simply uploading your transaction history the application will generate your report that outlines how much tax you need to pay based on your trasactions.

Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. The original software debuted in 2014. USA UK Canada and Australia.

The Crypto Tax Calculator Australia is a hassle free and helpful application for anyone who has conducted crypto transactions. How is crypto tax calculated in Australia. Every transaction can be adjusted or tailored using the Grand Unified Accounting GUA spreadsheet to fit the investors best possible tax outcome using their preferred accounting method.

We can see the gainloss on each transaction clearly.

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Best Crypto Tax Software Top 5 Bitcoin Tax Calculator 2022 Coinmonks

Next Steps Australia Crypto Tax Report Cryptotrader Tax

Crypto Com Tax Tool Review 2022 Free Tax Calculator By Crypto Com

How To Use Crypto Com Tax Software Free Crypto Tax 2021 2022 Calculator Cheatsheet Fangwallet

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Koinly Crypto Tax Calculator For Australia Nz

How To Use Crypto Com Tax Software Free Crypto Tax 2021 2022 Calculator Cheatsheet Fangwallet

Crypto Tax In Australia The Definitive 2021 2022 Guide

![]()

Cointracking Crypto Tax Calculator

Crypto Tax In Australia The Definitive 2021 2022 Guide

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Crypto Tax Calculator Home Facebook

![]()

Cointracking Crypto Tax Calculator

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Koinly Review Mar 2022 Cryptocurrency Tax Made Easy Yore Oyster